Blog

Safeguarding Your Life Insurance: Consequences of Missed Premium Payments and How to Preserve Your Coverage

Life insurance is a vital component of a comprehensive financial plan, offering security and peace of mind for individuals and their families. A...

Fully Paid-Up Life Insurance Policies: A Guide by Paola Rodriguez of Rodriguez Wealth Group

Life insurance can be a complex topic, full of unfamiliar terms and jargon. One term you might encounter is "fully paid up" when discussing life...

When Life Changes, So Should Your Insurance: A Guide to Updating Your Coverage

Life is a journey filled with unexpected twists and turns, and as we navigate through its ever-changing landscape, our insurance needs must adapt alongside us. From marriage and starting a family to career transitions and health adjustments, each milestone brings unique considerations that require a closer look at our insurance coverage. By understanding the significance of changing insurance coverage and consulting with experts in the field, we can ensure that we have the right protection to safeguard ourselves and our loved ones. In this article, we will explore the various situations that may prompt a need for adjusting insurance coverage and provide valuable insights on how to navigate these changes effectively. Don’t wait until it’s too late—take control of your insurance needs and enjoy the peace of mind that comes with knowing you’re adequately protected throughout life’s remarkable journey.

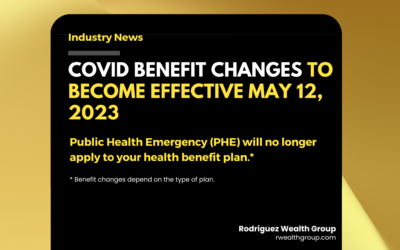

Preparing for the End of the Public Health Emergency: A Guide to Your Health Benefit Plan’s Coverage

As we approach May 12, 2023, it’s important to be aware of the upcoming changes to your health benefit plan’s COVID-19 coverage. The Public Health Emergency (PHE) established in March 2020 to combat COVID-19 is set to expire on May 11, 2023, which means federal requirements under the PHE will no longer apply to your health benefit plan. However, standard plan coverage will be reinstated for COVID-19 vaccines, COVID-19 tests, and anti-viral treatment. Read on to learn more about how these changes could impact your coverage.

What is a permanent life insurance policy?

Permanent life insurance policies offer lifelong coverage and a cash value component that grows over time, making them a popular choice for those looking for both protection and savings. There are different types of permanent life insurance policies available, including whole life insurance, universal life insurance, and variable life insurance, each with their own features and benefits. Whole life insurance provides a fixed premium and a guaranteed death benefit, while universal life insurance offers more flexibility in premium and death benefit amounts. Variable life insurance allows policyholders to invest in different options, but carries more risk. At Rodriguez Wealth Group, our financial advisors can help you choose the right permanent life insurance policy for your needs and budget.

How does life insurance companies determine how much to charge?

“Life insurance is an essential financial product that provides peace of mind to those who want to ensure their loved ones are financially protected after they pass away. But have you ever wondered how life insurance companies determine how much to charge for their policies? In this blog post, we’ll explore the factors that underwriters consider when determining the cost of life insurance. From age and gender to health and lifestyle, understanding these factors can help you make informed decisions when choosing a life insurance policy that fits your needs and budget

How can I save money when buying life insurance?

As a financial advisor, I often get asked about life insurance and how to balance the need for coverage with the cost of the premiums. Life...

When is the best time to buy life insurance?

The best time to buy life insurance is when you have a need for it and can afford the premiums. Here are some life events that may indicate a need...

Honduras Mission Trip

In February, I had the incredible opportunity to travel to Honduras on a mission trip with my fellow members of the Rotary Club FishHawk-Riverview....

How does life insurance compare to other investment vehicles?

Life insurance is often compared to other investment vehicles such as stocks, bonds, mutual funds, and real estate. Here's how life insurance...

Should I get life insurance on my kids or grandkids?

Whether or not to get life insurance on your children or grandchildren is a personal decision that depends on your individual circumstances and...

The Birth of RWG – Rodriguez Wealth Group

For as long as I can remember, I’ve been hiding in the shadows of other’s successes. On the outside, I was confident. But deep down, I didn’t feel...